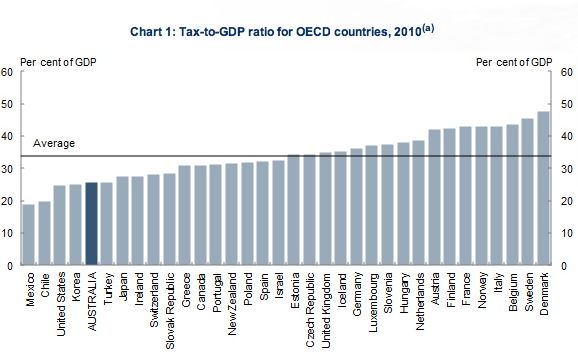

The Government released the Pre-Election Fiscal Outlook recently amid claims and counterclaims about the reliability of the figures within. Both sides have nominated the economy as the most important issue this election cycle, and it's featured strongly in both leaders' debates. Yet each have managed to ignore the most pressing issue in our economy, at least as it relates to the role of government.

Revenue shortfalls are becoming a global reality, but will only get worse over the next 40 or 50 years

The Henry Tax Review, or Australia's Future Tax System Review, found a raft of areas in which taxes were either counterproductive or unnecessary.

Included among these were stamp duties and luxury taxes on new vehicles, payroll taxes and property transfer taxes. Meanwhile, the Liberal party has committed to removing the only piece of progress on the review's recommendations, the mining tax.

The Henry Review was a response to several emerging trends, some of which have become tired, yet telling, cliches.

Our ageing population is going to seriously impact on the number of Australians working, so we can expect to see significantly decreased income tax receipts. At the same time our health costs are rising, and will continue to do so, also due to the ageing population. We've already seen tax revenue fall lately, as our tax base is not well established to survive hardship.

The Henry Tax Review included a recommendation to cut the company tax rate from its current level of 30% to 25% in order to stimulate business activity. Each party has committed to move some way towards this, without making any changes to address the shortfall in revenue this will create.

The Liberal party, traditionally proponents of lower taxes, haven't made any commitments about stamp duty or luxury car tax. They would presumably have the support of Ken Henry in doing so, provided revenue shortfalls were made up in one of the areas Mr Henry identified.

There is a significant problem on the horizon, and are fortunate that a commission was set up to investigate its impact. Revenue shortfalls are becoming a global reality, but will only get worse over the next 40 or 50 years. The next few terms of government will be vital in addressing these issues, but for fear of the unpopularity of change, our leaders aren't touching them.