A WAR of words has broken out between Labor and the Coalition over whether an incoming Abbott Government would seek to raise the GST.

The Coalition says it won't do any such thing, while the Labor Party — literally pointing to an article in the Australian Financial Review — maintains the Liberal Party has a secret plan to increases taxes.

But why is the GST such a taboo?

In the below article, Professor John Freebairn makes the case for a higher GST, to help fund reductions in more-distorting state stamp duties and federal income tax.

Quick links: A broader tax base | A higher GST rate

A larger GST to replace stamp duties | A larger GST to reduce income tax

Some background - the current GST

The GST introduced in 2000 is Australia's broad-based consumption tax applied at a flat rate of 10 per cent. In 2009-10, GST revenue was $46.4 billion, or 13 per cent of all taxation revenue. It has a 'destination' tax base which exempts exports and taxes imports. This tax base is relatively price non-responsive, or inelastic, hence the low distortion costs of the GST. The GST applies to about 60 per cent of a comprehensive consumption tax base. Exempt products include basic food, health, education, childcare and water.

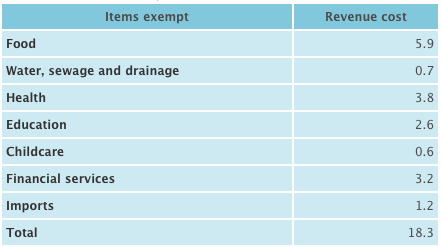

The complicated GST provisions relating to financial services mean that households are under-taxed via the non-taxation of value-added financial services, whereas businesses are over-taxed through being unable to claim GST offsets on financial services they purchase. The exemption of imports valued at less than $1000 has become highly contentious through the claims of retailers that internet purchases from overseas suppliers are undermining local industry. Table 1 shows estimated GST revenue foregone through these exemptions.

Formally, the GST is collected by the Commonwealth Government. The revenue is then redistributed to the states (and territories) as untied grants. The pattern of distribution across the states is based on principles of horizontal fiscal equalisation (HFE) as determined by the Commonwealth Grants Commission. HFE seeks to provide each state with a comparable ability to provide services to their constituents taking into consideration differences in (i) their ability to collect own-source tax revenues, and (ii) the costs of providing services.

There is a general consensus that while businesses pay the GST to the Commonwealth, they then pass on the extra costs to households in higher prices. That is, households pay the final or economic incidence of the GST. Given that consumption as a share of income tends to fall as incomes rise, the GST by itself has a regressive incidence. However, tax reform packages should be assessed in terms of the final incidence of the aggregate of all taxes.

TABLE 1: GST base exemptions and revenue loss ($ billion in 2010-11)

A broader GST tax base

Both the experience of New Zealand (NZ), and the arguments articulated in the Mirrlees Review (2010, 2011) for the UK, suggest greater efficiency and simplicity with a comprehensive consumption base for the GST with removal of the current exemptions listed in Table 1. Restoring distributional equity, as represented by the status quo, requires recycling much of the extra GST revenue to governments and households, with consequent changes to federal-state financial relations.

Consider now the efficiency and simplicity arguments for a NZ-type comprehensive GST base. Distortions to household purchase decisions across different products will be removed. There is no compelling market-failure or equity argument for a GST on necessity clothing but not food, or among utilities on electricity but not water. Complexity is involved for GST-exempt providers of health and education and the GST treatment of business services, cleaning and other GST-taxable activities they might provide. A comprehensive base provides for greater transparency and neutrality of tax treatment across government, non-profit and private-for-profit providers of health, education and childcare services. Exemptions in general, and grey lines between exempt and non-exempt goods and services, invite costly and societally wasteful rent-seeking lobbying.

Large potential gains for national productivity are available from a shift in the mix of taxes from those with relatively high distortion costs to the GST with its much lower distortion costs

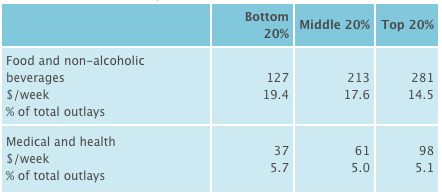

At the time of the introduction of the GST, key reasons for the exemptions of what are considered necessities of life and higher shares of expenditures for those on low incomes were the regressive effects of a GST. These concerns are real and supported by available data. However, in the context of the total tax system, exempting some 'necessity of life' items from the GST is a very blunt and ineffective way of meeting society's equity goals when compared with a progressive income tax combined with a means-tested social security system. For example, while the better-off spend a smaller share of their income on food than those on lower incomes, the percentage difference is not large. Moreover, the better-off spend twice as many dollars per week on food as shown by Table 2. To maintain the current redistributive effects of the tax system in aggregate, some of the revenue windfall by removing current exemptions for food, health, water and so on will need to be recycled in a progressive fashion to households via increases in social-security rates and reductions in marginal income tax rates.

Table 2: GST base exemptions and revenue loss ($ billion in 2010-11)

In the cases of health, education and childcare, governments at both federal and state levels fund a proportion, but not all, of these services for reasons of external benefits and equity. Bringing these services into the GST net for the efficiency and simplicity reasons noted above will require a similar proportion of the extra GST revenue to be recycled to the two tiers of government. Importantly, these subsidies will be more transparent, direct and better targeted at meeting the reasons for government intervention – namely, correction of external benefits and equity of opportunity.

A higher GST rate

Another set of reform options is to raise the current GST rate of 10 per cent to, say, 12.5 or 15 per cent, either on the current GST base or on a more comprehensive base, and to use the revenue gained to replace or reduce other more-distorting taxes. Highly distorting taxes to be replaced (or reduced) include state stamp duties on insurance and property transfers, and federal income taxation. This reform idea is similar to the philosophy behind the introduction of the GST in Australia in 2000, the rate increases in NZ and the UK in 2010, and increases in VAT rates in other countries.

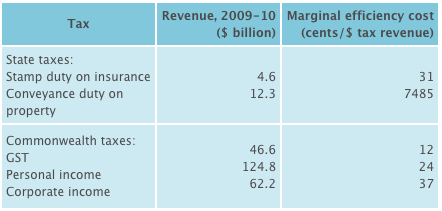

Table 3 provides a list of the taxes high on the list to be replaced, or reduced, with the revenue from a higher GST. Details are given of the revenue collected in 2009-10 and of the Henry Review (2010) estimates of the marginal efficiency costs of the different taxes. An increase in the GST rate by one percentage point would generate about $4.6 billion a year on the current base, and $5.5 billion on a comprehensive base.

Taxation involves a transfer of revenue (and ultimately of labour and other resources) from the private sector to the public sector. It also alters decisions in the private sector, such as shifting from market employment, which is income taxed, to leisure and home work which are not taxed. The changed decisions involve a loss of private-sector welfare greater than the dollar-for-dollar transfer. This loss to the private sector is referred to as the marginal efficiency cost of the tax. For example, in Table 3, the last dollar of stamp duty on insurance involves a total loss of welfare to the private sector of $1.31, with $1 being a transfer to government and 31 cents being the marginal efficiency cost.

Table 3: Revenue and efficiency costs of selected taxes

Differences in the marginal efficiency cost of different taxes provide one measure of the efficiency benefits, or increases in national productivity, of increasing the GST rate to fund reductions of more distorting taxes. For example, using the Henry Review (2010) numbers in Table 3, another dollar of GST to replace a dollar of stamp duty on insurance involves an additional cost of 12 cents but saves a cost of 31 cents, for a net gain of 19 cents per dollar. Of course, there are legitimate arguments about the estimated magnitudes of the efficiency costs of different taxes (including my concerns with the Henry Review numbers). However, few doubt the ranking of these costs and that a tax-mix change involving a larger GST to replace the taxes listed in Table 3 offers very large gains in national productivity.

A larger GST to replace state stamp duties

State stamp duties on insurance and the conveyance of property are among the most-distorting taxes, and their removal would bring important gains in simplicity. Stamp duties on motor vehicles also deserve removal but, as argued by the Henry Review (2010), as part of a separate tax reform package to capture the costs of road funding, pollution and congestion. In the case of conveyance duty, a reform package would involve a broader base and a higher rate of land tax, roughly to fund the unimproved land value component, and a higher GST to fund the improvements component of property value transfers.

Stamp duties are a form of indirect tax, similar to the GST – they are an additional cost, much of which is passed on to buyers as higher prices. But stamp duties fall on business activities with extra distortions relative to a GST with its final incidence on household consumption. Conveyance duty as a transaction tax also reduces transfers of ownership of property from less productive to more productive owners and uses. There is no market-failure reason to impose a higher indirect-tax burden of stamp duty plus GST on insurance relative to the flat GST burden on most other products. These additional distortions lie behind the higher marginal efficiency cost of stamp duties relative to the GST shown in Table 3.

A larger GST to replace the stamp duties tax reform package, as a change in the composition of indirect taxation, will have a negligible effect on the aggregate cost of living. In the short run, some winners and losers seem inevitable, however these will decline over time as net gains in productivity occur.

Aggregate revenue neutrality across the different government jurisdictions could be maintained by a corresponding reduction in Commonwealth special purpose payments. The states would benefit from more stable revenues.

A larger GST to reduce income taxation

A tax reform package involving a larger GST to fund reductions in income taxation would raise national productivity. At the same time, with careful design, the package can be approximately aggregate revenue neutral, revenue neutral between the Commonwealth and the states, and (roughly) distributionally neutral across broad demographic and income categories. Of course, these latter constraints could be relaxed.

The efficiency case for replacing an income tax with a broad-based consumption tax is as follows. Both taxes fall on decisions to join the workforce, invest in skills, and vary hours of work. For a given market wage, income taxation reduces disposable income, while the GST (and indirect taxes more generally, which are passed on as higher prices to households) reduce the quantity of goods and services which can be purchased from disposable income. So, labour market distortions are similar with a tax mix change involving a larger GST and a smaller income tax which is revenue and equity neutral.

By contrast, while income taxation falls on capital income as well as labour income, albeit as a hybrid mess of different tax rates (Henry Review, 2010) – and distorts both the aggregate levels of saving and investment and the composition of different saving and investment options, such as housing, business plant and equipment, and superannuation – the GST with its consumption base lowers the tax burden on saving and investment. In the context of Australia as a net capital importer and a small open economy, the price sensitivity or elasticity of the supply of capital, and especially from non-residents, is high, and much higher than for labour. As argued in the Henry Review (2010), the Mirrlees Review (2010 and 2011) and the NZ Tax Working Group (2010), given these differences in factor supply elasticities, a change in the tax mix towards a GST and away from income tax will, over time, increase capital inflow, boost capital stock (and associated better technology), and enhance labour productivity and market wages. Lower, but still positive income tax rates reduce the dispersion of effective tax rates on different saving and investment options, which in turn reduces tax distortions to the mix of the larger capital stock and increases productivity.

For households, the higher average cost of living with a larger GST would be offset by recycling the additional GST revenue as higher social security rates and lower marginal income tax rates. The income tax rate schedule would become more progressive. In the longer run, the productivity gains of a shift in the tax mix from income tax towards the GST will provide a net gain in national income. Under an aggregate revenue constraint, while the current distribution of the aggregate tax burden can be maintained for households across broad demographic and income groups, in a particular year there will be some losers, as well as winners, within each group.

The first-round increase in GST revenue for the states – and the fall in income tax revenue (and increase in social security outlays) for the Commonwealth – changes Commonwealth-state financial relations. The current balance could be restored with a commensurate reduction of Commonwealth special purpose payments to the states.

This is an edited version of a public lecture. It was originally published here.

© University of Melbourne, 2013.